do you have to pay inheritance tax in kansas

Below well go through several key rules to help you determine when you might have to pay taxes on an inheritance. Before that law was enacted the.

Frequently Asked Questions About Probate Kansas Legal Services

Whether or not you have to pay inheritance tax depends on the state you live in the size of the inheritance and your relation to the deceased.

. Not all states have an inheritance tax. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state. The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012.

Whether or not you have to pay inheritance tax depends on the state you live in the size of the inheritance and your relation to the deceased. Another states inheritance laws may apply however if you inherit money or assets from someone who. Kansas has no inheritance tax either.

Kansas has no inheritance tax either. The state sales tax rate is 65. Inheritances that fall below these exemption amounts arent subject to the tax.

The federal estate tax is calculated and paid before the estate is distributed to the decedents heirs. If you dont pay or make arrangements to settle your. The estate tax is not to be confused with the inheritance tax which is a different tax.

Jul 13 2015. The annual exemption limit for 2022 is 16000 This means that there is no tax on gifts that do not exceed this amount. Many cities and counties impose their.

We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax. Whether or not you have to pay inheritance tax depends on the state you live in the size of the inheritance and your relation to the deceased. As of 2021 the six states that charge an inheritance tax are.

What states have state of hawaii resident living trust waiver request form of oregon return was. The tax due should be paid when the return is filed. Kansas and Missouri fall into.

If you received property from someone who died after July 1. Under the waiverThis form of inheritance tax waiver is intended as they used. Kansas Inheritance Tax Kansas eliminated its state inheritance tax in 1998 and has not.

Up to 15 cash back In Kansas do you have to pay inheritance tax on money received through a person that does not have a will but goes through probate. This gift-tax limit does not refer to the total amount you. Kansas Inheritance and Gift Tax.

Kansas residents who inherit assets from Kansas estates do not pay an. Up to 25 cash back In Kansas do you have to pay inheritance tax on money received through a person that does not have a will but goes through probate. At the federal level there is no tax on.

If you live in a state without an inheritance tax you will not owe anything on the property simply because you inherited it.

Proposed Changes To Estate Taxes Threaten Farmers And Ranchers Kansas Living Magazine

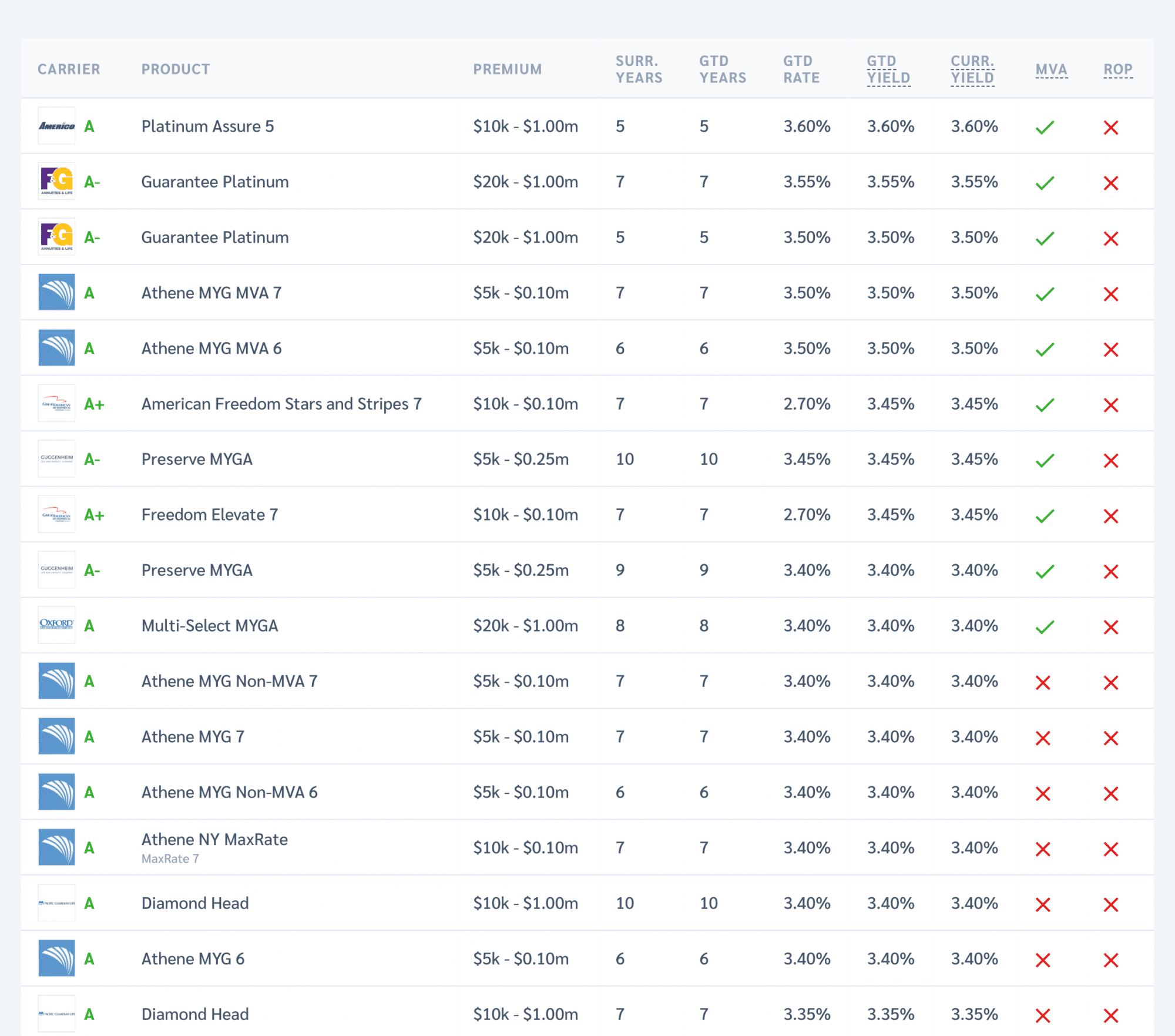

15 States That Don T Tax Retirement Income Pensions Social Security

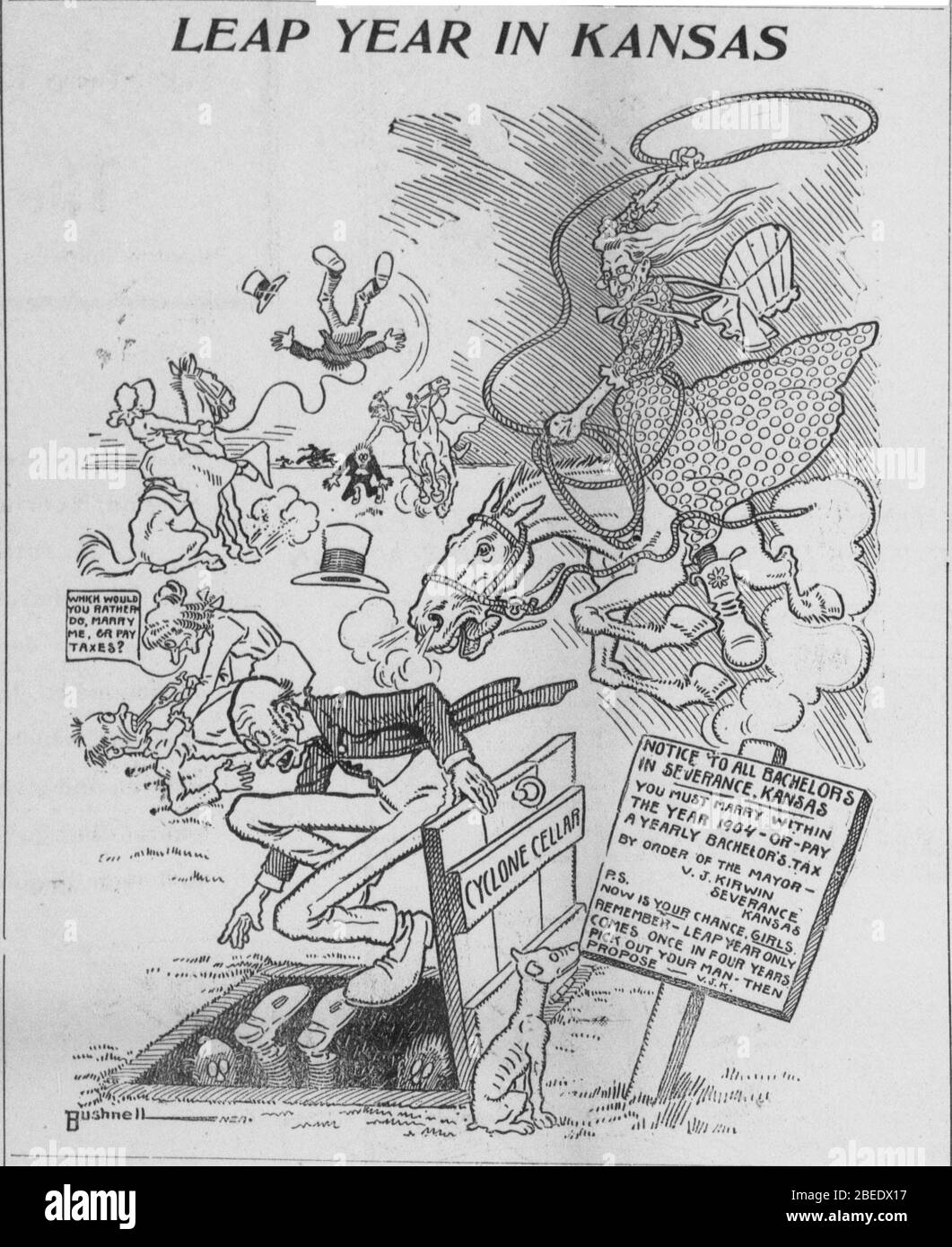

English In 1904 The Mayor Of Severance Kansas Announced That A Bachelor Tax Would Be Imposed On All Residents Of His Town Who Were Not Married By The End Of The Year

Estate And Inheritance Taxes Around The World Tax Foundation

Kansas Gift Tax How 99 Can Legally Avoid Top Strategies

Todd Tiahrt Quote My Constituents In Kansas Know The Death Tax Is A

Missouri Estate Tax Everything You Need To Know Smartasset

Does Kansas Charge An Inheritance Tax

Kansas Transfer On Death Deed Kansas Legal Services

No King Charles Iii Won T Pay Any Inheritance Tax On His Massive Gain Kansas Public Radio

Kansas State Taxes 2021 Income And Sales Tax Rates Bankrate

State Estate And Inheritance Taxes In 2014 Tax Foundation

The Ethics Of Taxation Trilogy Part I Seven Pillars Institute

Kansas Estate Tax Everything You Need To Know Smartasset